DOL’s Final Rule Increases Salary Threshold for FLSA Exemptions

On April 23, 2024, the U.S. Department of Labor (DOL) announced the new final rule, Defining and Delimiting the Exemptions for Executive, Administrative, Professional, Outside Sales, and Computer Employees, which updated and revised the regulations for determining whether certain salaried employees are exempt from minimum wage and overtime requirements under section 13(a)(1) of the Fair Labor Standards Act (FLSA). Specifically, this includes increases to the standard salary level and the highly compensated employee (HCE) total annual compensation threshold.

The final rule does not change the special salary levels that currently apply in Puerto Rico and the other U.S. territories. Although DOL proposed changes to these special salary levels in the 2023 Notice of Proposed Rulemaking (NPRM), it did not finalize these proposed changes. However, DOL stated it will address the special salary levels for U.S. territories in a future final rule.

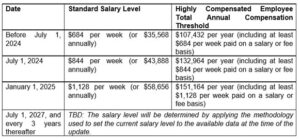

For the covered jurisdictions, the effective date for this final rule is July 1, 2024, and its full increase will take effect by January 1, 2025. A mechanism for regularly updating these thresholds was also introduced, starting with an initial update in July 2024 to reflect earnings growth. The threshold will automatically update every three years (beginning on July 1, 2027) using current earnings data.

The following table summarizes DOL’s changes to the FLSA exemptions:

|